19 climate finance and startup speakers

Plus, 99% of the investment industry’s $69T controlled by one demographic, 3x3x3 learning framework from McKinsey, climate risk disclosure vs. investors' blood pressure

Climate risk disclosure — Requiring vs. asking.

Are we about to begin mandatory climate disclosure in the US?

At least two public giants think so.

“Both Apple and Salesforce are calling on the SEC to issue rules to require that companies disclose third-party-audited emissions information to the public, covering all scopes of emissions, direct and indirect and the value chain.”

As summarized by Mindy Lubber, CEO of Ceres, in Forbes recently — The Time For Mandatory Climate Disclosure Is Now.

On one hand, it’s easy for two companies with low carbon footprints to take the lead on this, knowing that more carbon-intensive blue-chip peers could be hit harder. On the other, peer pressure is awesome when it creates more positive outcomes.

And maybe this kind of disclosure is good for more companies than we’d think.

A recent Harvard Business Review article notes the following:

“The extent of climate-risk disclosure increases by approximately 4.6% for each environment-related [shareholder] proposal that is submitted, and that the effect rises to 6.8% when environmental shareholder activism is more effective is initiated by institutional shareholders with a long-term holding horizon.”

“The stock market responds favorably to such disclosures, with a disclosing firm’s stock price increasing by 1.2% on average in the days following a disclosure.”

“This suggests that investors value higher transparency with respect to climate change risks and that disclosure tends to benefit disclosing companies…Put differently: Investors dislike uncertainty and are willing to pay a premium for less opaque companies.”

Let’s hope something happens soon. If not, this will continue to happen:

60 largest banks in the world have invested $3.8 trillion in fossil fuels since the Paris Agreement (CNBC)

Put your head in the sand much?

Upfront fees may be nice, but stranded assets, not so much.

For some sense of scale, the Financial Times in February estimated about $900 billion in stranded assets for the energy sector.

Can diverse investors be better investors?

First…

The inspiration and research for this comes from the ever insightful Marilyn Waite, Climate and Clean Energy Finance Program Officer at the William and Flora Hewlett Foundation, in her Greenbiz article.

Second…

The statistics about demographics for US investment professionals are shocking.

Partners in venture capital firms are only 4.1% female, with those women being 67% white, 16% East Asian, 7.7% South Asian, 4.8% Black and 3.5% Latinx.

98.7% of mutual fund, hedge fund, private equity and real estate fund managers are led by white males.

79% of employees at ESG funds are white, according to a 2019 survey.

Third…

It should not be a secret that diversity can boost profits, aside from being a lot more fun. On the topic of business benefits from diversity, here’s a good summary from the World Economic Forum.

Fourth…

How can you learn more and do something about this?

Get engaged with VC Include and their Diverse Climate Fund Manager initiative, “engaging diverse emerging managers that are addressing climate change in their strategy.” Shout out to Taj Ahmad Eldridge and Bahiyah Robinson for their leadership on this.

Check out Due Diligence 2.0 Commitment, a set of nine steps to diversify leadership and talent in climate finance.

Get to know more diverse asset managers — minority, women, veteran and disabled-owned — in this directory run by Emerging Manager Monthly

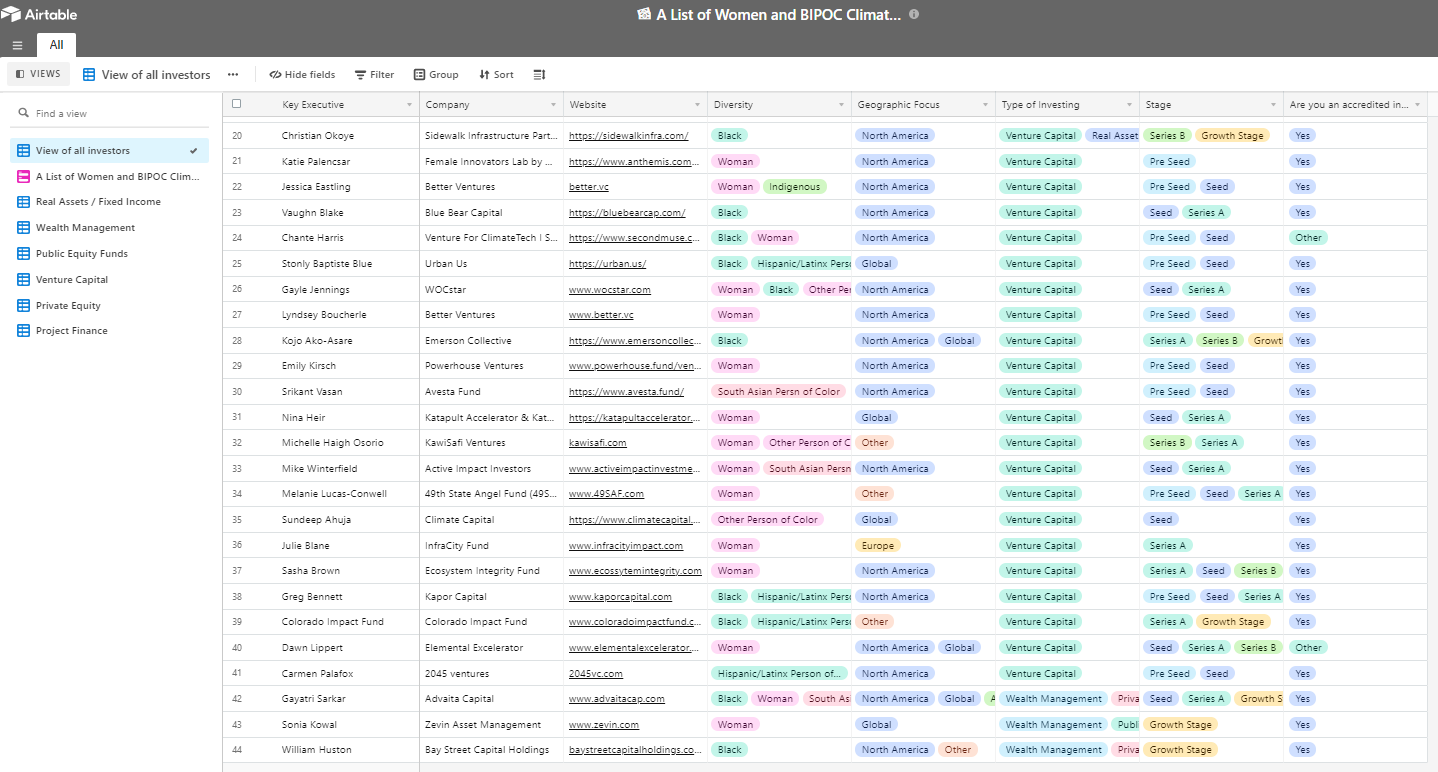

Learn more about women and BIPOC climate fund investment advisers and asset managers this AirTable put together by Hannah Davis of Techstars and Marilyn.

Shout out to 19 climate finance and startup guest speakers.

With my Duke University teaching wrapping up for the semester, I want to give a big thanks to the following climate changemakers that joined my classes to share more stories from the trenches.

I encourage you to check them out and see how you can support their mission or collaborate towards combined goals.

Energy Finance:

(Fun to coteach with Dr. Emma Rasiel, Associate Chair of Economics at Duke!)

Matt Eggers - Principal, Breakthrough Energy Ventures

Climate tech VC investor

Andrew Ellenbogen - Managing Director, EIG Partners

Energy private equity investor

Brad Dockser - Founder and CEO, Green Generation

Green real estate strategy and proptech investor

Aaron Ratner - President, Cross River Infrastructure Partners

Carbon upcycling, hydrogen, and renewable energy project developer

Cleantech Startups & Investors:

Ryan Kushner - Cofounder, Third Derivative

Startup accelerator

Cody Simms - SVP, Climate & Sustainability, Techstars

Startup accelerator

Abe Yokell - Co-Founder, Congruent Ventures

Climate tech VC investor

Allison Myers - Principal, Bouyant Ventures

Climate tech VC investor

Pandwe Gibson - CEO, EcoTech Vision

Distributed greentech manufacturing

Amy Duffuor - Principal, Prime Impact Fund

Climate tech VC investor

Diego Saez Gil - CEO Pachama

Machine learning with satellite imaging to measure carbon captured in forests

Clean Energy in Emerging Markets:

(Cotaught with off grid energy rockstar, Jonathan Phillips - Director, Energy Access Project, Duke University)

Kate Steel - Cofounder, Nithio

Credit intelligence and financing for African energy access projects

Sam Kwon - Senior Director for Energy, Millennium Challenge Corporation

U.S. foreign assistance agency providing investment to alleviate poverty

Nicole Poindexter - CEO, Energicity

Solar + storage minigrids for West Africa

Kristina Skierka - CEO, Power for All

Ken Newcombe - CEO, C-Quest Capital

Off grid power and clean cooking project developer

Kelly Carlin - Manager, RMI / Third Derivative

Business model innovation for off grid energy

Jim Walker - Senior Director, Sustainable Energy for All

United Nations-connected financing for off grid energy

3x3x3 — McKinsey & Company on how to learn.

Summer is almost here. As such, what could be more fun than learning something new?

(Or so I suggest to my three kids with looks of confusion and concern.)

This method from McKinsey might be just the distillation you need to chart out and accomplish those goals.

What’s with the numbers?

3 things you want to learn

3 months to learn them

3 people with whom you’ll learn (#accountability)

Got feedback?

I craft these newsletters on email-free Fridays to help you scale ventures and investments that address climate change, boost personal productivity, and become better leaders.

What do you want to see more of? Less of?

How can this be more useful (or entertaining) to read?

Feel free to respond directly to this email with 2-3 bullets before your next coffee break. (Caveman brevity is totally acceptable.)

Or connect on LinkedIn and drop me a note there.

Got a friend who might like ZERO?

I appreciate the many shares, sign ups, and emails. Keep ’em coming.

Make it a great week (because it’s usually a choice).

— Chris

P.S.

We finally gave in and launched our Climate Torch podcast on most of the platforms out there.

I invite you to listen to the first 13 episodes with these badass climate CEOs and ask, “How can I support their mission?” Plus, we’ve got a pipeline of ten more CEO interviews in the works.

And it would be awesome if you left a kind review, on your favorite podcast platform. (Pretty please with vanilla stevia on top.)

But don’t do it for my ego. (My nine-year-old daughter already has that taken care of.) Do it instead so that more folks can discover the podcast and be inspired by these climate CEO’s stories.

—

Dr. Chris Wedding

Founder and Chief Catalyst, Entrepreneurs for Impact

Peer-to-Peer Advisory Groups + Executive Coaching + Investor Intel for Climate CEOs

—

Securities offered through Finalis Securities LLC Member FINRA/SIPC. IronOak Energy Capital and Finalis Securities LLC are separate, unaffiliated entities.